Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

For a more in depth idea of the 95% mortgages available to you and what is currently on the market; including some information on any government schemes available, then read on. If you want a no obligation good idea of how much the low deposit mortgage that you require will cost you before you wade into the property market, then for your free quote simply fill in our shorton line enquiry form ( no credit search will be done from this form) or give our in house adviser team a call on 0800 298 3000 from a landline or 0333 003 1505 from a mobile to speak to talk through your scenario confidentially.

For a more in depth idea of the 95% mortgages available to you and what is currently on the market; including some information on any government schemes available, then read on. If you want a no obligation good idea of how much the low deposit mortgage that you require will cost you before you wade into the property market, then for your free quote simply fill in our shorton line enquiry form ( no credit search will be done from this form) or give our in house adviser team a call on 0800 298 3000 from a landline or 0333 003 1505 from a mobile to speak to talk through your scenario confidentially.Low Deposit Mortgage Explained

In today`s mortgage market, a low or small deposit would be classed as 5%. Your deposit is the money that you have saved which can then be put up against the mortgage on your property for the lender`s security. Here is an example of what a 5% deposit would be and the mortgage you would need on different property values:

In today`s mortgage market, a low or small deposit would be classed as 5%. Your deposit is the money that you have saved which can then be put up against the mortgage on your property for the lender`s security. Here is an example of what a 5% deposit would be and the mortgage you would need on different property values:- Property Value= £100,000

5% Deposit= £5,000

Mortgage Required= £95,000 - Property Value= £150,000

5% Deposit= £7,500

Mortgage Required= £142,500 If you fit into this category, and you have saved up a 5% deposit you need to be looking for 95% mortgages. A 5% deposit allows you to purchase up to 95% of the value of the property that you want to purchase. Please note you may also be required to save for other fee`s involved with the low deposit mortgage. It is important to remember that whilst the deals are out there, if you can save a bigger deposit, you will have access to better mortgage products as your mortgage will not be considered as great a risk from the lenders perspective.

Low Deposit Mortgages For First Time Buyers

If you are looking to get your foot on the property ladder then you will need to start saving a deposit. This can be a tricky step as recent economic uncertainty has put pressure on many first time buyers. Saving a substantial deposit for current property values may seem out of reach for many couples and families alike. With this in mind low deposit mortgages can be a very attractive option and provide the necessary `leg up` required to get on the first rung of the property ladder. Tempted by a 95% or 90% mortgage and think you may have the deposit available? Fill in our short online enquiry form so that we can get back to you free with a free quote with absolutely no obligation to proceed.Government Schemes Available For Low Deposit Mortgages

With recent economic pressures still hanging over us, the government has released a number of policies and schemes to try and kick start the property market once again which certain lenders have decided to take up. Referred to as `Help to Buy` and `Help to Buy 2` these schemes are tied heavily to low deposit mortgages with first time buyers in mind. Generally they fall into two categories; if you are looking to purchase a new build property you could take out an equity loan from the government to effectively increase your deposit. In this scenario the government take an equity stake in the property of around 15% this then combined with your deposit reduces the percentage the mortgage lender has to lend on the home down to 80% meaning they are much more likely to proceed. Alternatively if you want to move home or purchase an existing property, you could use the mortgage guarantee scheme. Both schemes give the lender more security so that they are more willing to lend as much of the risk involved with low deposit mortgages is removed. Whilst they are particularly handy for first time buyers `Help to Buy 2` can also be used for existing homeowners with low deposits looking to move home. If you would like more information regarding either of the schemes for your individual circumstances contact the office on the above number to speak to an understanding adviser.Loan To Value Calculator

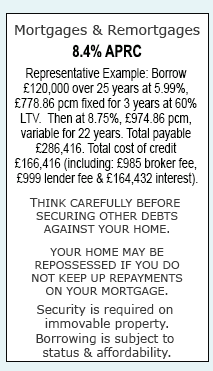

Saving a deposit can be a long winded task, even if you are only looking for low deposit mortgages. Depending on the property value you are considering, it is useful to have a target of what exactly you need to save. Head over to our free and easy to use loan to value calculator to see what LTV you are working with according to the deposit you have saved so far or give us a bell and we will do it for you.Mortgages & Remortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential